Introduction

Your credit score is more than just a number—it’s your financial reputation. It determines if you can get approved for credit cards, car loans, student loans, or even rent an apartment. It can also affect your interest rates and, in some cases, job opportunities.

But here’s the problem: many beginners don’t know where to start. Maybe you have no credit history, or maybe your score took a hit. The good news? Building or repairing credit doesn’t take years. With the right strategies, you can see improvements in just a few months.

This guide will walk you step-by-step on how to build credit score fast in 2025, with proven methods, practical examples, and tips for avoiding costly mistakes.

Why Credit Score Matters in 2025

- Loan approvals – Better scores = higher approval odds.

- Lower interest rates – Save thousands over time.

- Rental opportunities – Many landlords check credit before renting.

- Insurance rates – Some providers use scores to set premiums.

- Employment checks – Employers in finance and government often review credit history.

In short: your credit score = financial opportunity.

How Credit Scores Are Calculated

Understanding what impacts your score helps you improve it faster.

- Payment history (35%) – Do you pay on time?

- Credit utilization (30%) – How much of your available credit do you use?

- Length of credit history (15%) – How long you’ve had accounts.

- Credit mix (10%) – Types of accounts (cards, loans, etc.).

- New credit inquiries (10%) – Too many applications lower your score.

💡 Focus first on payment history and utilization—they make up 65% of your score.

Step 1: Get Your First Credit Card

If you have no credit, you need to establish a history. Options include:

- Student credit cards (designed for beginners).

- Secured credit cards (require a refundable deposit).

- Authorized user (added to a parent’s or friend’s card).

Start small: use your card for groceries or gas and pay it off in full every month.

Step 2: Always Pay on Time

Even one late payment can drop your score by 100+ points. To avoid this:

- Set up autopay for the minimum balance.

- Use reminders or budgeting apps.

- Pay early if possible—especially before the statement closing date.

Step 3: Keep Credit Utilization Low

Credit utilization = balance ÷ limit. Example: if your limit is $1,000 and you spend $700, that’s 70% utilization—too high.

- Aim for under 30%; best is under 10%.

- Make multiple small payments throughout the month.

- Ask for credit limit increases after 6–12 months of on-time payments.

Step 4: Limit New Applications

Every new application triggers a “hard inquiry,” which temporarily lowers your score.

- Apply for only 1–2 cards per year when starting out.

- Don’t apply for multiple cards at once.

- Build history with your first card before expanding.

Step 5: Monitor Your Credit Report

Mistakes happen—accounts may be misreported or fraud may occur.

- Check free reports at AnnualCreditReport.com (3 per year).

- Use free tools like Credit Karma for updates.

- Dispute errors directly with credit bureaus (Equifax, Experian, TransUnion).

Step 6: Become an Authorized User

One of the fastest hacks:

- Ask a family member with good credit to add you as an authorized user.

- Their positive payment history boosts your score.

- You don’t even need to use the card.

Step 7: Mix Your Credit Over Time

Lenders like to see variety:

- Credit card + student loan.

- Later: car loan or mortgage.

- Personal loans (but only when necessary).

Don’t rush—diversify naturally as your finances grow.

Common Mistakes That Hurt Your Credit

- Carrying a balance “to build credit” (MYTH—only hurts you with interest).

- Closing old accounts (shortens credit history).

- Applying for store cards just for discounts (low limits, high APR).

- Ignoring bills (cell phone, utilities can be reported).

Realistic Timeline: How Fast Can You Build Credit?

- 1–3 months: Score appears after first credit activity.

- 3–6 months: Noticeable improvement if you pay on time.

- 6–12 months: Potential to reach 680–720 (good score).

- 12–24 months: Strong foundation for 740+ (very good score).

Consistency is more powerful than hacks.

Case Study: Building Credit in 12 Months

Let’s say Emma, a student, starts at no credit history.

- Month 1: Gets a Discover Student card.

- Months 2–3: Keeps utilization under 20%, pays in full.

- Month 6: Requests a credit limit increase.

- Month 8: Added as authorized user on parent’s card.

- Month 12: Score rises to 710.

Pros & Cons of Building Credit with Credit Cards

Pros

- Quick way to establish credit history.

- Cashback and rewards.

- Fraud protection.

- Builds good financial habits.

Cons

- High APR (18–28%).

- Temptation to overspend.

- Missing payments damages score.

FAQ

Q: Can I build credit without a credit card?

Yes. Student loans, rent reporting services, and utilities can help, but credit cards are the fastest.

Q: Should I carry a balance to improve my score?

No. Paying in full is always better.

Q: How long does it take to go from bad to good credit?

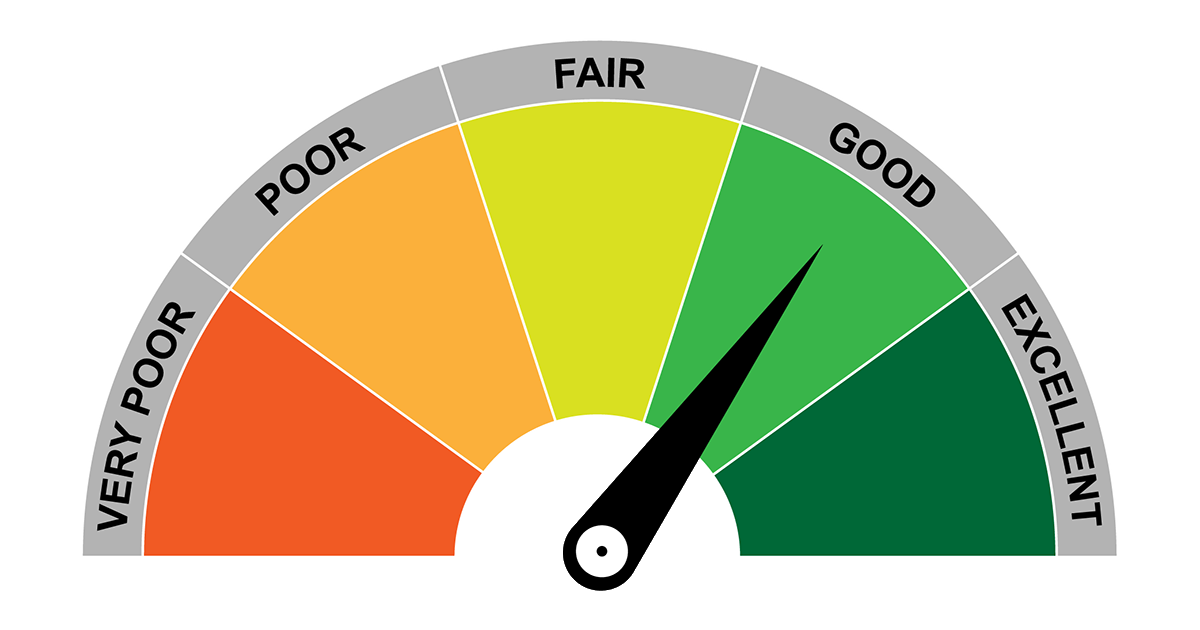

With discipline, 6–12 months can take you from poor (580) to good (680+).

Q: What’s the easiest first card to get?

Secured cards (like Capital One Secured) or student cards (like Discover it® Student Cash Back).

Q: Can missed payments be removed from my report?

Only if they were errors. Legit missed payments usually stay for 7 years.

Advanced Tips to Boost Credit Faster

- Use a credit builder loan from local banks or apps like Self.

- Set spending reminders in your card app.

- Pay bills twice a month to keep utilization low.

- Leverage cashback to pay down small debts.

- Negotiate with creditors for lower APRs if needed.

Conclusion

Building your credit score fast in 2025 is about strategy and consistency. Start with a student or secured card, pay on time, keep balances low, and monitor your progress. Within a year, you can transform your credit from zero (or poor) to strong—and unlock better financial opportunities for the future.